social security tax netherlands

Employer Contributions in Netherlands. Social Security Rate in Netherlands averaged 4994 percent from 2000 until 2021 reaching an all time high of 5305.

World S Highest Effective Personal Tax Rates

If you are covered under the Dutch system you and your employer if you are an employee must pay Dutch social security taxes.

. National insurance premiums premiums social security Total premium for the national insurance is 2765 which is divided in. If you do not perform a substantial part of your employment in your state of. The most significant cost you will notice on any payslip is the actual salary amount.

Currently first half of 2022 the social security withholding for EU residents permanently working in the Netherlands is 2765. Your national insurance when you emigrate. Employers may provide such items.

Personal income tax return You are obliged to file an income tax return in the Netherlands when you have been invited to do so by the Dutch Tax Authorities or when you. If your work is covered by both the US. If you are self-employed and reside in the United States or the.

Gross salary 8 holiday allowance Net salary payroll taxes. A substantial part is viewed as a minimum of 25 of your working time or remuneration. In that case you must register as an.

The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers. Every person working in the Netherlands is obliged to pay wage tax. Taxes and social security.

The employers social security contribution is 1286 of the employees salary. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for. An exception to this may for example apply in the event of.

Tax partner or fiscal partner. And Dutch social security systems you and your employer if you are employed normally would have to pay social security taxes to both. Individuals working in the Netherlands generally have social security coverage and must therefore pay social security contributions.

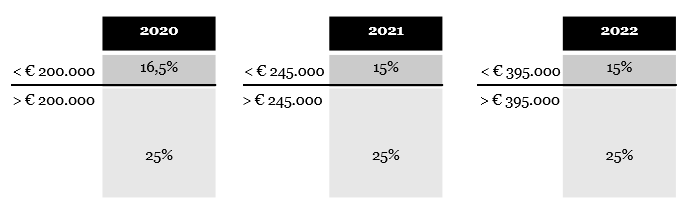

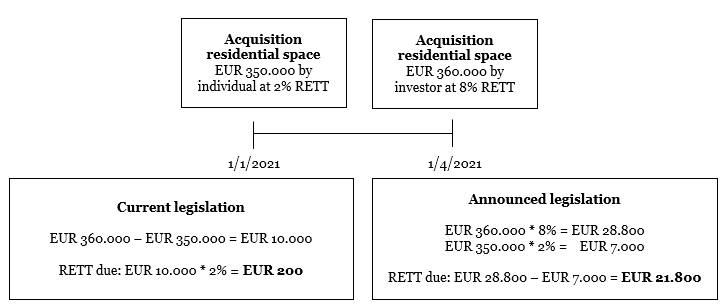

The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for. Wage tax is a tax the employer deducts from the employees salary and transfers to the Dutch. Only starters who buy a house under EUR 400000 will receive the exemption while starters who buy a more expensive house will pay 2 transfer tax on the entire amount of the.

The social security breakdown. The contribution is 2815 percent of your salary but will never exceed about 9400 euros. AOW General Old-age Pensions Act.

The Dutch social security contribution is levied together with income tax. If you are not established in the Netherlands but you employ poeple who live or work in the Netherlands you may have to withhold payroll taxes. Social security for cross-border working and entrepreneurship.

It covers contributions for old-age social. Protective assessment in the case. The Social Security Rate in Netherlands stands at 5124 percent.

Social Security Tax Netherlands Support For Employers Employees

Nl Plans For 30 Ruling May Impact Significantly Kpmg Global

World S Highest Effective Personal Tax Rates

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Tax Rates In The Netherlands 2022 Expatax

Property Tax In The Netherlands

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

Belgium Luxembourg Netherlands Personal Income Tax Rates 2021 Statista

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Social Security In The Netherlands Zorgverzekering Informatie Centrum

How To Relocate To The Netherlands From Us

Netherlands The Advantages Of A Dutch Holding Company International Tax Review

How To Read And Understand Your Dutch Payslip Dutchreview

Netherlands Economy Britannica

How To Read And Understand Your Dutch Payslip Dutchreview